Megan Kopka, CFP®, CRPC®

Unlike many advisors, I started in the financial industry like you, as an investor. I remember being advised to open a Roth with those old Series E bonds and then watched our “retirement” quickly double and quadruple in the fast ride up in the dot com tech bubble: I then watched it crash. I waded through statements and thought huh? Why did that happen? The answer was simple: bad advice. I had to retool. I knew I had to save for my retirement. That was a given. But how? I was a math teacher, so the math wasn’t going to stop me. I understood the time value of money calculations. So, I entered the financial industry to problem solve. I loved it. I soaked up knowledge like a sponge. And through my experience as a teacher, I had the ability to explain to my clients what to do with their money, so they understood it. Plus, I get the responsibility of handling other people’s money. It’s huge, and I take that VERY seriously. Suits, ties, and marble floors don’t make you money. Someone who understands finances, can explain finances, and will care about you and look after you, does. And that would be me. Set up a meeting with me. I’ll prove my value to you.

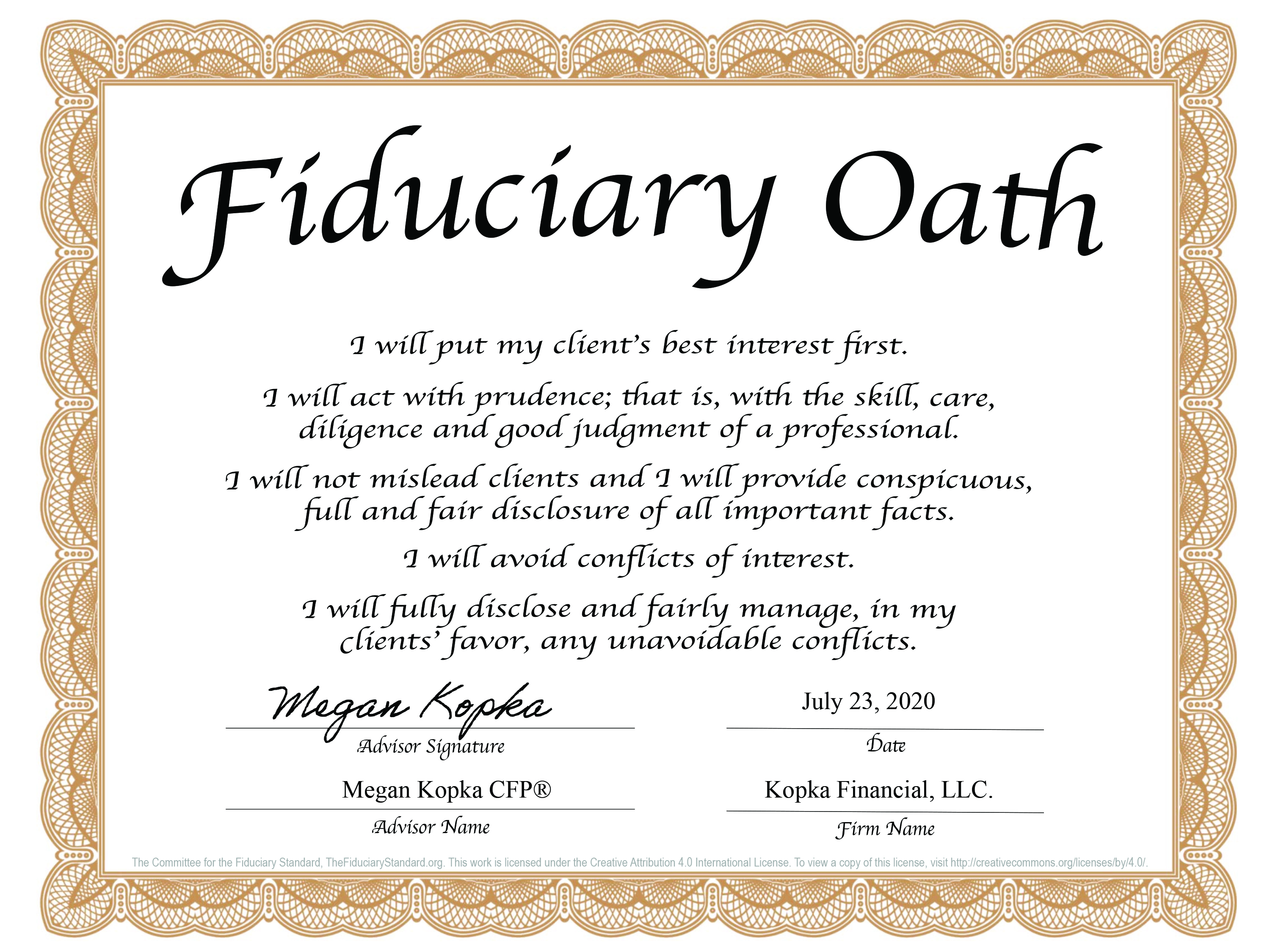

I started in the financial industry in 2007. My experience and in field education began at the grandeur of the large wire houses until my personal life led me to a small, local planning firm and from there, to an elite solo advisor working with high net worth clientele. Industry experience, education, and guidance combined with my naturally curious, resourceful and investigative nature led me to the task of opening my own firm, Kopka Financial. LLC. To best serve my client’s and your needs as a fiduciary, I embrace the truly independent model for today’s fiduciary advisor.

Initially, I sought out training for advising families of children with disabilities as a personal interest, a place I gravitated to as a perpetual volunteer. This training was a natural interest with a sincere way to give back and offer my expertise. Later and not long after working as a special needs advising professional, the training became a personal experience. Living with a person with disabilities is an experience, one which creates a paradigm shift where you may never see the world the same, and that is good. My household, in part, was covered by Medicare and a disability supplement coupled with income supplemented by Social Security Disability Income. This is also something you will not find that many advisors have personal experience with. I bring a lot more to the financial experience as a widow, single woman, solo parent and mother, former caregiver and medical advocate, and business owner.

Additionally, I am a proud member of The National Association of Personal Financial Advisors (NAPFA). NAPFA is the country’s leading professional association of Fee-Only financial advisors—highly trained professionals who are committed to working in the best interests of those they serve.

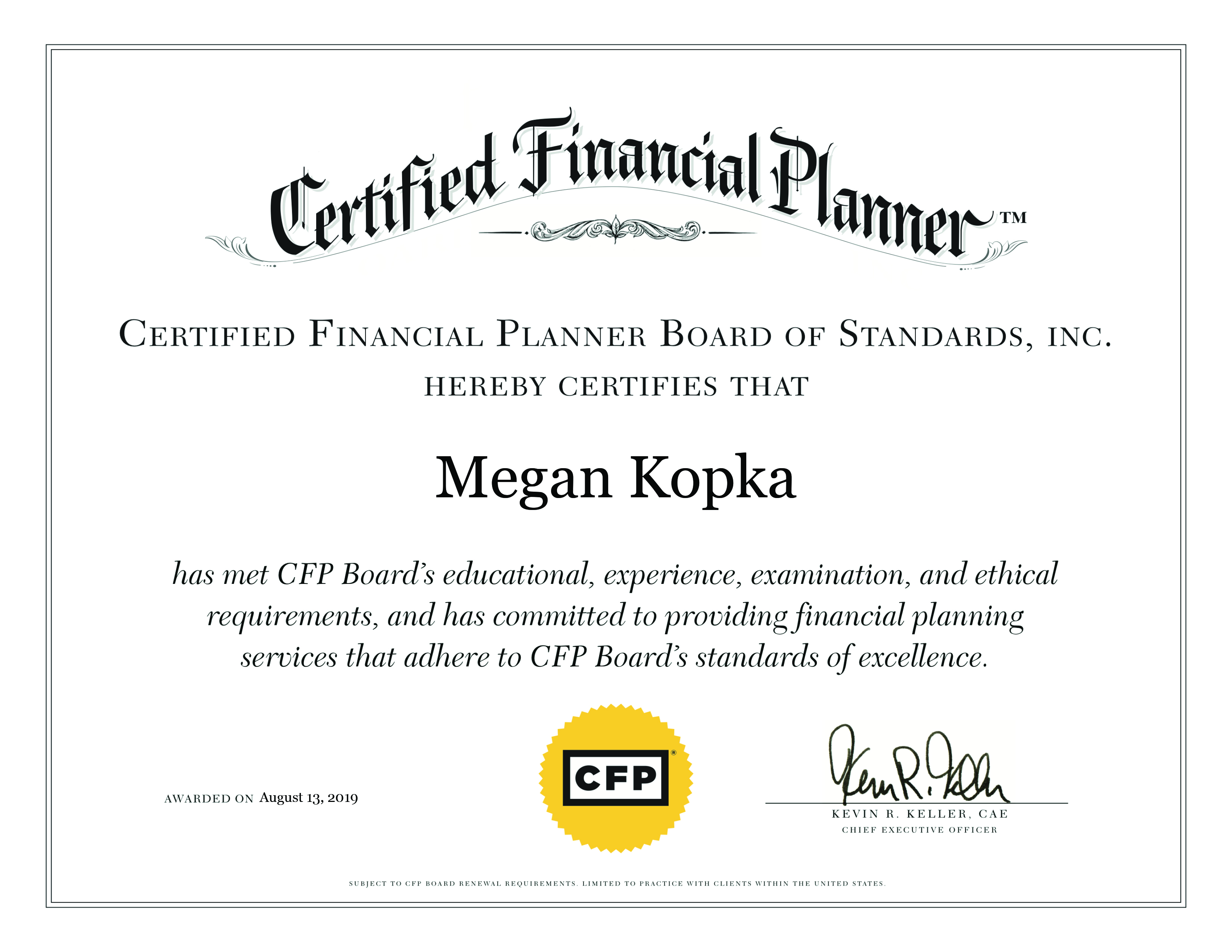

What is a CFP®?

A CFP® is a certified professional that qualifies to use the marks through their education, experience, ethics and examination set forth by the CFP® Board. The CFP® Board is a non-profit organization acting in the public interest by fostering professional standards in personal financial planning through its setting and enforcement of their qualification requirements. A CFP® Professional is a fiduciary, meaning they must put the client’s interest ahead of their own.